To help investors that want to buy Kobe investment property, we have reviewed three income-generating rental properties that are for sale in Kobe now. Our intention is to show actual examples, so investors can learn more about the types of property available for investment in Kobe, as well as the cost and quality of some specific investments.

When you are ready for a local agent that can find high-yield rental properties for investment in Kobe, contact KobeAgents.com for more information.

Five Examples of Property for Investment in Kobe City

* Example #1: 1R Condominium Rental Property in Kaigandori, in Chuo-ku, Kobe

* Example #2: 1K Condominium Rental Property in Kusunokicho, in Chou-ku, Kobe

* Example #3: 6-Unit Apartment Rental Property for Sale in Kamisawa, Hyogo-ku, Kobe

* Example #4: 6-Unit Apartment Investment Property for Sale in Higashidemachi, Hyogo-ku, Kobe City

* Example #5: 2-Unit Mixed-use Commercial Residential Investment Property in Kamisawadori, in Hyogo-ku, Kobe

— Why Focus on Specific Investment Properties in Kobe?

— How We Chose the Kobe Real Estate for Investment in this Assessment

— Online Listings for Investment Property in Kobe

— The Best Real Estate Investments in Kobe Are Not Listed Online

— Real Estate Brokers that Specialize in Investment Property in Kobe

There are much better investment properties available in Kobe. We can help you find them. For now, let’s get into some specific examples:

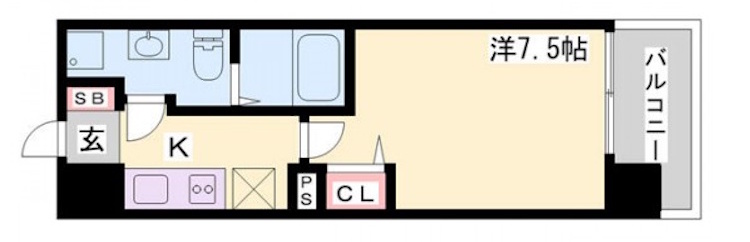

Example #1: 1R Condominium rental property in Kaigandori, in Chuo-ku, Kobe

— Investment Category: Single condominium unit as a rental property in Chuo-ku, Kobe

— Size: 24.6 m2

— Year Built: 2013

— Price: 16,300,000 JPY

— Annual Rental Income: 849,600 JPY

— Rental Yield: 5.21%

— Price per Square Meter: 662,332 JPY

This Chou-ku condominium (what locals call a “mansion”) for sale is a good example of a single unit in a condominium building to use as a rental property. This particular unit is in a relatively new build (2013), in a good neighborhood a short walk from Harborland. The unit is small (1R), but based on the lobby and exterior of the building, likely modern, and in good condition. This is one of two condominium investment properties in this review; this one was slightly higher priced, has more floor space, and rents at a higher rate; the annual rental yield is 849,600 JPY, with a monthly rent of 70,800 JPY. The unit is small – about 25-30% smaller than similar condos for investment in Sapporo. The relatively high price for such a small unit is likely because of the excellent location and the unit presents as new. The rental yield of 5.21% is particularly strong.

Notes on the investment: The neighborhood for this rental condo in Kobe is nice. The block the building is located on is a mix of tall buildings and commercial structures, and the streets were relatively empty, but attractive. There is an elevated highway just across the street from this building, which may be what can be seen from south facing windows (not ideal). The rental yield of 5.21% is not particularly strong, and that is before maintenance fees and owner’s fees are paid. The building includes an elevator, which investors know increases annual maintenance costs. Given the fees, the actual yield is likely much lower.

This is a class “B” or “class “A” unit, in what is probably a class “A” neighborhood. It’s a new building, in a great part of Kobe; it is likely a safe investment, if not a particularly profitable one.

Example #2: 1K Condominium rental property in Kusunokicho, in Chou-ku, Kobe

— Investment Category: Single condominium unit as a rental property in Chuo-ku, Kobe

— Size: 21.3 m2

— Year Built: 2023

— Price: 16,200,000 JPY

— Annual Rental Income: 767,880 JPY

— Rental Yield: 4.74%

— Price per Square Meter: 758,072 JPY

This property is another 1K condominium in Kobe that generates rental income for a real estate investor. This unit is similar to the other condominium investment property we review above, however; it is newer, smaller, and was rented for a lower rate. This is is an investment condo in Chou-ku, Kobe, this unit is in Kusunokicho – close to, but not easily walkable to central Sannomiya-area Kobe. The unit is very new (2023), but generates less rental income than the previous unit; annual income from rent for this property is 767,880 JPY, and monthly rent 63,990 JPY. While this is the lowest cost of any property in we present here, the yield at 4.74% is the lowest of any of the properties included in this review.

Notes on the investment: This 1K Chou-ku Kobe investment condominium is a very nice, modern building, in an attractive neighborhood. The property is almost directly on top of the Okurayama Station on the Seishin-Yamate Line. At 21.3 m2, it is a very tiny living space (the smallest condominium we have evaluated in months). As the rental yield is 4.74%, and there would be monthly owner/maintenance fees, the return on investment for this property is likely too low to be attractive to many owners. It may be a suitable place to live, but not a good investment. However, before we could finish writing this review, the unit was off the market (it may have in fact sold, at or below asking).

This is a class “A” building in a class “B” or class “A” neighborhood in central Kobe. Not a good investment, but a great place to live.

Example #3: 6-Unit Apartment Rental Property for Sale in Kamisawa, Hyogo-ku, Kobe

— Investment Category: Apartment building rental property in Kobe

— Size: 165.8 m2

— Year Built: 2018

— Price: 72,800,000 JPY

— Annual Rental Income: 4,632,000 JPY

— Rental Yield: 6.36%

— Price per Square Meter: ¥439,083 JPY

This property is a 6-unit apartment building for sale in Kobe, in the Kamisawa district of Hyogo-ku. This building was built in 2018, and has six 1K units that generate rent. This Hyogo investment property is located a short walk from Kamisawa. The six units generate 4,632,000 JPY in annual rent, or 386,000 per month. Dividing the total monthly income by six, it appears the units rent for close to 64,000 each. That seems like strong income for such small units, but they are relatively new, and the access to the subway is nearly ideal. The rental yield is 6.36%, which is highest yielding rental property in this review.

Notes on the investment: This looks like a relatively good investment. The neighborhood is quiet, pleasant, working class. The Kobe-Sannomiya Station is just 13 minutes away (including the walk to the station). The building is not particularly nice; and we were surprised it was built as recently as 2018 – it looks older. This type of unit is a classic investment for an investor with limited capital. Six units provides some diversity of income; if a unit is temporarily unoccupied, the remaining units can continue to generate cashflow. As this building only has three floors, there is no elevator, and maintenance cost is lower than the condominium investment properties we featured above.

This is a class “C” building in a class “B” or “C” neighborhood. Price may not be ideal, returns are not fantastic, but this is the best example in this review of available Kobe real estate investments.

Example #4: 6-Unit Apartment Investment Property for Sale in Higashidemachi, Hyogo-ku, Kobe City

— Investment Category: Multi-family building for rental income in Kobe

— Size: 134.8 m2

— Year Built: 2016

— Price: 75,000,000 JPY

— Annual Rental Income: 4,512,000 JPY

— Rental Yield: 6.02%

— Price per Square Meter: 556,215 JPY

This property is another interesting example of a multi-family apartment for sale in Kobe, that could serve an investor with a relatively small budget. This is a relatively new investment property in Higashidemachi in Hyogo-ku, in Kobe City. It has six rentable units; 1K units generating monthly rental income for a Kobe real estate investor. The annual income from rent is 4,512,000 JPY, or 376,000 per month. We don’t have a rent roll for this property, but dividing the monthly income by six suggests the units rent for 62,000 JPY per month (slightly lower rent, but similar to the 6-unit rental property we feature above). The location for this property is less central, and the neighborhood is less ideal, so the value to these renters may be harder to justify than some other properties in this review. The rental yield for this Hyogo-ku real estate investment is 6.02%; the second best yield in this review.

Notes on the investment: The location of this property is in a working class neighborhood, close to the bay, on the other side of Harborland from the city center. It is not a convenient or central location; Google Maps cites the nearest station as accessible via a 14 minute walk (Harborland Station) or a 16 min walk (Shinkaichi Station). The neighborhood was clean, but very humble. The structure itself is almost industrial looking; all concrete, no windows on the east side of the building at all, some small windows facing a wall on the west side. These unit may be comfortable on the inside, but are very unappealing on the outside. Other than the concrete structure, the property features a drab parking lot, with zero landscaping. If these units were difficult to rent, it would not be surprising.

This is a class “B” or “C” property in a class “C” (or “D”) neighborhood. This is Japan, so everything feels relatively clean and safe, but this was one of the most humble neighborhoods we have toured.

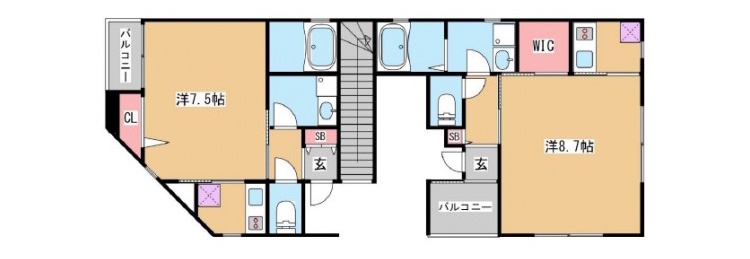

Example #5: 2-Unit Mixed-use Commercial Residential Investment Property in Kamisawadori, in Hyogo-ku, Kobe

— Investment Category: Mixed-use commercial/residential property for investment in Kobe

— Size: 237.9 m2

— Year Built: 2000

— Price: 80,000,000 JPY

— Annual Rental Income: unknown

— Rental Yield: unknown

— Price per Square Meter: unknown

This is an interesting example of Kobe investment property for sale – it is a mixed-use, two unit property, with a retail shop on the 1F, and a relatively large 4LDKS residence on 2F – 4F. Looking at the floor plan, it’s not clear that there are two separate entrances; it may be that the entrance to the residence passes through the retail space (currently used as a shop that sells acai bowls). It could be ideal of a tenant that would like to run a retail/restaurant business, and live above the unit (perhaps with a family, even a large one). The location is excellent; 2 minutes from Minatogawa Koen and Minatogawa Koen Station. Rental income on the property is unknown (it could be the property was previously owner-occupied.

Notes on the investment: The unit appears to be a very narrow four-story building, but after looking at the floor plan, the building is larger in the rear of the property. It is an odd-sized, flag-shaped property, penned in by larger buildings. The windows that face the street (which face south) are likely the only windows (that don’t face walls). It’s not clear the building has egress, other than on 1F via the shop. The building was built in 2000, but feels old; it’s not a “nice property.” The location, however, is excellent. Almost on a corner, just moments from a station, near a large attractive park, it could a good location to both live and work. It could possibly rent for decent income, but find the right tenant could be difficult. For an owner-occupied business that benefits from walk-by foot traffic, it could be ideal.

This is a class “C” building in a call “B” neighborhood.

Why Focus on Specific Examples of Investment Real Estate

When investors consider buying real estate in Kobe for investment, they often begin with the same questions: What returns are available from Kobe real estate investment? What is the purchase price for investment property in Kobe? The answers to those questions always depend on the type of property (condominium rental unit, single family home rental property, multi-family investment property in Kobe, etc), the location of the property, the age of construction, the quality of construction, etc.

In this article we have reviewed five examples of income-generating properties in Kobe for investment. These examples provide some exact numbers for investors. From these examples, investors can begin to set some expectations about rental property in Kobe, and can prepare for what they might see when they work with a local Kobe real estate broker to purchase property for their own investments.

The examples presented here are just samples. Because of the nature of how investment property is bough and sold, there are better real estate properties available in Kobe. To see real estate investments with higher returns, talk to a local Kobe real estate broker.

How We Chose the Properties in This Assessment

To create a more interesting analysis for investment property in Kobe, we intentionally chose properties of a certain types, within similar price ranges. We intentionally only focused on available real estate investments in the central area of Kobe’s Chuo-ku and Hyogo-ku wards.

None of the properties we used for this review are particularly good investments. This report is, however, a good teaching tool to help investors to picture some specific examples of different types of Kobe property for investment. We intentionally focused on more affordable properties that may be within reach for investors; smaller, multi-unit properties in Kobe of six units or less. Larger, more traditional Kobe apartment buildings for sale exist, and may be better investments for investors that can fund those larger, more costly transactions.

By selecting similar properties, of similar age of the structure, similar real estate investment strategy, investors go beyond generalities and begin to see some practical examples of the real estate market in Kobe.

Websites that List Investment Property for Sale in Kobe

Several websites list real estate in Kobe for investment purposes. HokkaidoAgents.com publishes a list of several websites that show property for sale in Japan. It is also possible to visit local real estate companies in Kobe, that can provide examples of their own investment properties for sale, as well as other Kobe multi-family buildings for sale that are available locally. The property database REINS which is produced by the Japanese national government can also sometimes be a good resource for property for sale (REINS listings can only be accessed by licensed Kobe real estate agents).

There are also Japanese online listings websites that include rental properties in Kobe, that only show real estate for investment. Those websites are produced in Japanese, and the real estate companies that pay for those listings tend to do business with Japanese buyers, with contracts and negotiations in Japanese only.

For help finding suitable investment properties in Kobe, contact a local real estate agent in Kobe that speaks English.

The Best Real Estate Investments in Kobe Are Not Listed Online

Revenue-generating properties that are listed on public real estate websites in Kobe tend to have lower yield than properties that are never listed online.

Experienced real estate brokers will usually try to buy the best properties themselves. When they do not want a property, or when they don’t have the available funds to buy a property, they can make a good commission by selling the property to someone they know (sometimes another agent or broker, sometimes an investor). They can find a buyer from their network of local contacts. If a property is listed online, it has first been passed-over by all these local insiders.

For unlisted places and special deals, though, information tends to circulate locally and within a tight circle. Our industry is still very old fashioned.

— Toshihiko Yamamoto, from The Savvy Foreign Investor’s Guide to Japanese Properties

There are excellent investment properties with high returns in Kobe. Those properties are sold via the private relationships in the local community of brokers and Kobe investment property owners. Contact us a good local Kobe real estate advisor to find good investment properties in Kobe.

Real Estate Brokers that Specialize in Real Estate for Investment in Kobe

Every mature community in Japan has a few smart real estate brokers, owners, and investors. For visitors or foreigners buying real estate in Kobe, finding a good agent that speaks English is an important part of success. This is especially important for investment property in Kobe, as the best properties are not listed on public websites – you will need a local Kobe real estate company to provide access and introductions.

For More Information:

— Examples of rental income properties in Osaka City

— See our guide to buying investment properties in Osaka

— We show several different types of real estate investment in Osaka

— Off-market Properties in Osaka

— Examples of real estate investment properties for sale in Sapporo, Japan

— Different Real Estate Investment Opportunities in Sapporo

— Examples of condominiums for sale in Sapporo, Japan

— A guide to the concept of Domestic Contacts in Japanese Real Estate

— Services that Help Foreigners Buy International Real Estate

— See our piece about various Taxes in Japan

— Our detailed Guide to Paying Property Taxes in Japan

See Also:

— Books about real estate in Japan

— Books about investing in apartment building and multi-family property

— A review of The Complete Guide to Buying and Selling Apartment Buildings by Berges